Property investment is the act of purchasing a property to earn a return on investment (ROI). This is achieved through various strategies, see my blog post ‘A Basic Overview of Property Investment Strategies in the UK’. A return on deployed capital is achieved through rental income, capital gains, or a combination of both.

Property investment is a popular investment strategy, with many investors choosing to invest in real estate as a way of diversifying their investment portfolios. With the uncertainty that we have been experiencing over the last few years, investing in property continues to outperform other asset classes.

In today’s article, we are going to talk a little about what property investment is. Why I think it is one of the best asset classes to invest in. The benefits of investing in property and the risks involved.

So, let’s get into it…

What is Property Investment?

Property investment is the process of purchasing property and profiting from it. The property can be either residential or commercial and can be purchased for a variety of reasons. This includes rental income or to benefit from capital appreciation.

The primary goal of property investment is to generate a positive cash flow. Depending on the strategy that you intend to utilise the cashflow will come in different forms, such as:

Buy-to-Let (BTL) – If you intend to build a portfolio of properties, your cash flow will be from the monthly rents.

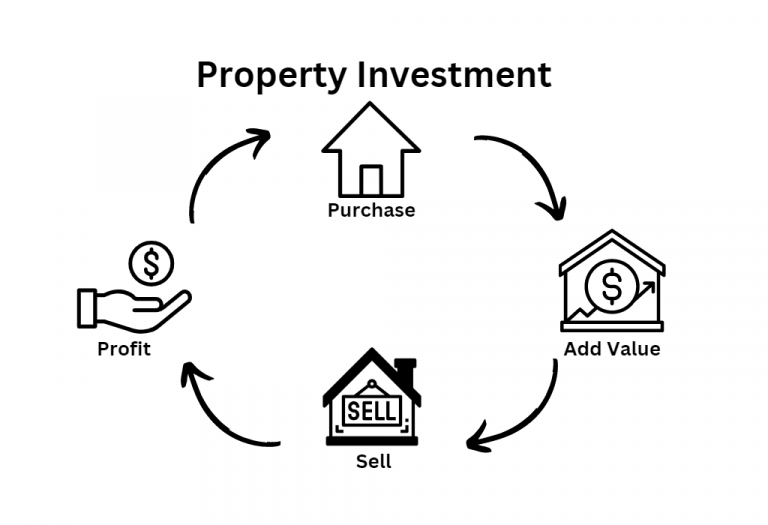

Property flipping – If flipping properties (buy, add value and resell) is your preferred strategy, your cash flow will be more sporadic and will come in larger chunks of money.

There are other strategies, however, the two mentioned are the two main categories and are the most widely used strategies in the UK.

Buy-to-Let is considered to be a long-term strategy, where you would be looking to benefit from the capital appreciation of the property, whereas property flipping is a short-term strategy, generally used to build up cash reserves.

Whether you decide to do buy-to-let and build a portfolio or if you prefer the idea of flipping or you want to do a mixture of both, you must do your research and figure out your ideal strategy that aligns with your goals.

Why Invest in Property?

I have said it before and I will always say it, I think that property is one of the best asset classes to invest your hard-earned cash into. Over the long term, you can see the trend that the UK property market grows 10% year on year, which rivals the returns if you look at the stock market.

However, with property investing you only need on average put down 25% to own the asset, whereas with stock you will need to put up the full amount.

I have listed several reasons below why I think that people should invest in property:

- Steady Cash Flow: Rental properties can provide a steady income and could eventually pay you a full-time income from it. It can also be relatively passive if you have the correct systems in place, however, it will take time to scale your portfolio to this point.

- Appreciation: As I said property values tend to increase over time due to capital appreciation. On average house prices in the UK increase by 10% year on year, therefore property could potentially double in price in as little as 10 years.

- Hedge Against Inflation: In recent months we have seen massive inflation numbers with it peaking at over 10%, however, if we look at the rental market, rents have been increasing with inflation. Therefore, investing in BTL can help beat inflation.

- Property is in High demand: It is well known that there is a housing shortage in the UK and that is not going to be resolved anytime soon. I have spoken with agents that have had over 500 applicants for one property, which is ridiculous.

- Build Generational Wealth: Property is a great way to build wealth over time, it can be used to build generational wealth as well and help you to build a legacy that can be passed to your children.

- Tangible Asset: Real estate is a tangible asset that can be seen and touched, which provides investors with a sense of security. It can be used to leverage debt by borrowing against it, this helps with scaling your portfolio.

There are loads of benefits to investing in property, I could go on for days about it, but I have only touched on my top 6 reasons to invest in property.

Different Types of Property Investment

The reason I enjoy investing in property is that there are loads of different ways that you can invest. You can change up your strategies as your business and knowledge grow.

If you are like me and you get bored relatively easily, then property investing is great. This is because when you get bored with a certain strategy you can start trying another without having to change the industry that you are working in.

- Residential Property Investment: This involves the purchase of a residential property to generate rental income or capital appreciation.

- Commercial Property Investment: This involves the purchase of a commercial property, such as an office building or retail space, to generate rental income or capital appreciation.

- Serviced Accommodation: This involves buying a property in an area that will be popular for short-term rentals (Airbnb or Vrbo), this is typically in city centre locations, beauty spots or seaside. This type of rental can be very lucrative.

- Property Flipping: This involves finding a property that needs renovation, adding value to the property by adding an extra bedroom, an extra WC or off-street parking and so on… The Property is then re-sold on the market to achieve a higher price than purchased for.

- Private Investment: If you do not want to be hands-on with your investments, some companies will offer you a fixed rate return on your capital and they will do all the work with the investments. It is a great way to create passive income.

Again, there are far more investment strategies than listed above, I have only included these strategies as I think they are the best way to get started. We are not involved with 2,3 and 5, they are strategies we wish to pursue in the future.

At Benchmark we do offer investment opportunities to private investors, if you would more information, please feel free and get in touch here.

Risks and Rewards of Property Investment

We have spoken about the benefits of investing in property above, I do think however it would be unwise of me not to warn you of the potential risks that are involved with investing in property. Like any investment, nothing is a sure thing.

It is my opinion that if you know the risks to look out for you can plan for them and help mitigate the risks involved, I have listed a few of the main risks involved with property investing below:

- Market Risk: Just as any investment property values are subject to changes due to current market conditions, such as changes in interest rates or economic downturns. It is advised that you keep up to date with current market trends to not be taken by surprise.

- Property Management Risk: There is a lot of legislation involved with property investment, which makes self-managing your properties very time-consuming. I advise you to find a good letting agent and they will take care of everything for you and make sure you are compliant.

- Liquidity Risk: Real estate investments are generally illiquid, meaning that if for whatever reason you need to sell it can be difficult to sell a property quickly.

- Interest Rate Risk: This is a problem that a lot of people are struggling with right now, with rising interest rates monthly cash flow can be decimated. A good investment at lower rates can quickly become a bad investment. I advise before buying always stress test your investments.

- Regulatory Risk: It seems these days that there is new legislation coming into force every other week, which can affect property values and rental incomes. Again, this is where having a good team around you helps.

Over Leveraging: Over leveraging means having too much debt built into your portfolio. Debt is a great tool to build your portfolio, however, if there was an economic downturn would you still be able to make all your debt repayments? It is something to think about.

Key Factors to Consider When Investing in Property

When investing in property always do your due diligence, there are several key factors you should pay attention to when carrying out your due diligence:

- Location: The location of the property is one of the most important factors to consider, as it can impact rental income, property values, and the type of tenants that are attracted to the property.

- Property Type: The type of property being purchased is also important, as different types of properties will have different end users. Always have in mind who you are aiming the property at.

- Rental Income: This comes down to knowing your numbers, it is essential to know your investment area inside out. Look for high-rental demand areas and the average rental for your type of property.

- Property Condition: Most investors will be willing to renovate a property, whether that is for the rental market or for flipping. Always look out for major works though, i.e., the condition of the roof, is there dampness or is there any subsidence? These can impact and return you are expecting.

- Financing: Investors should consider the financing options available to them, such as traditional mortgages or alternative financing options such as bridging finance or private investment.

- Investment Horizon: Investors should consider their investment horizon or the length of time they plan to hold the property. This can impact the type of property they invest in and the financing options available to them, always having a clear exit strategy.

- Tax Implications: Property investment comes with tax implications, such as property taxes, capital gains taxes, and income taxes on rental income. Investors should consider these implications when making investment decisions.

When starting in property I advise you to stick to your local area, you know what areas to invest in and where not. You will know where has the higher rental demand, where the dodgy parts are and have a rough idea of the ceiling price of your type of property will sell for.

Summary

In conclusion, property investment can be a lucrative investment strategy for those who are willing to put in the time and effort required. It offers the potential for steady cash flow, capital appreciation, and diversification benefits.

As we have shown it is not without its risks, such as market risk, property management risk, and liquidity risk. When investing in property, it’s important to consider factors such as location, property type, rental income, property condition, financing options, investment horizon, and tax implications.

That being said, I think it is the best asset class to invest your money into (I may be slightly biased). I am not saying that it is the be-all and end-all, but I do think that it is the most accessible way for most people to invest.

It has a relatively low entry point, only needing a 25% deposit for most BTL mortgages, a lot of people can access this type of cash by releasing equity from their homes or maybe even releasing money from a pension.

Anyway, I think I have rambled on for long enough now, I hope you have enjoyed this article, I would love to hear your thoughts on it, please feel free to leave a comment below and I will get back to you.

Email; Davidbrown@benchmarkpropertygroup.co.uk

Website: www.benchmarkpropertygroup.co.uk